GCC Cash Management Services Market Size: 2025 Outlook

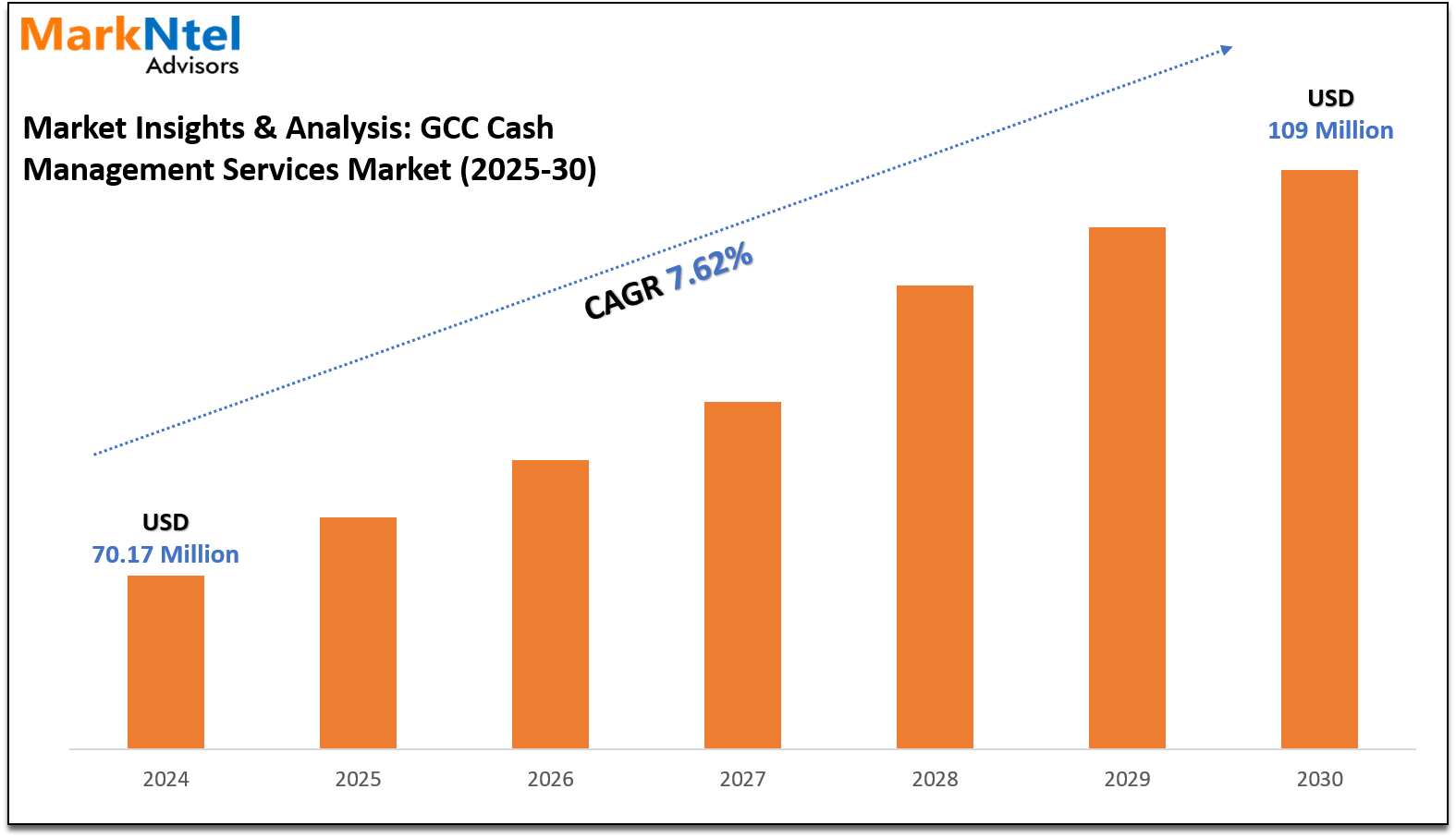

The GCC Cash Management Services Market is poised for significant growth, projected to reach USD 109 million by 2030, up from USD 70.17 million in 2024. This growth is estimated at a compound annual growth rate (CAGR) of approximately 7.62% during the forecast period from 2025 to 2030. Factors such as the rising demand for ATMs, increased cash transactions, and the dominance of cash payments in various sectors, particularly in rural and underdeveloped regions, are driving this market expansion. With continued advancements in technology and the increasing reliance on cash transactions, especially in regions like the UAE, Saudi Arabia, and Qatar, the GCC cash management services landscape is set to evolve and thrive.

GCC Cash Management Services Market Statistics

- Market Value in 2024: USD 70.17 million

- Projected Market Value in 2030: USD 109 million

- CAGR (2025-30): 7.62%

- Leading Region: UAE, accounting for over 40% of the market

- Key End-Users: Banks and Independent ATM Deployers dominate with more than 40% share in the banking sector.

[Stay informed about USA tariff changes with expert insights and timely information.]

Just Fill Out the Form for Get Sample of the Report! https://www.marknteladvisors.com/query/request-sample/gcc-cash-management-services-market.html

GCC Cash Management Services Market Trend

The GCC Cash Management Services Market is witnessing a transformative trend marked by the integration of Machine Learning (ML) and Artificial Intelligence (AI) technologies. These innovations enhance cash optimization processes in ATMs, enable accurate forecasting of cash demand, and streamline operations for better efficiency and customer satisfaction.

GCC Cash Management Services Market Key Growth Challenge

Despite the promising growth trajectory, the GCC Cash Management Services Market faces challenges due to the increasing adoption of digital payment methods. Government initiatives and advancements in fintech are contributing to the shift toward cashless transactions, which may impact the demand for traditional cash management services.

Leading Companies and Competitive Landscape of GCC Cash Management Services Market

The competitive landscape in the GCC Cash Management Services Market is characterized by a diverse array of key players, including:

- Fab Bank

- Trans Guard Group

- Cash Trans Group

- BRINKS

- Mashreq AI Islami

- RAKBANK

- Emirates NBD and others

These companies leverage strategic partnerships and technological advancements to strengthen their market position.

View the Full Market Insight & Statistics! https://www.marknteladvisors.com/research-library/gcc-cash-management-services-market.html

(“Engage with our team using your official business email to unlock full access and priority support.”)

GCC Cash Management Services Market Segmentation

The GCC Cash Management Services Market can be segmented by service type and region:

By Type

- Hardware & Software Maintenance & Upgrades- Market Size & Forecast 2020-2030F, USD Million

- Managed Services- Market Size & Forecast 2020-2030F, USD Million

- 24/7 Incident & Helpdesk Management- Market Size & Forecast 2020-2030F, USD Million

- ATM Monitoring- Market Size & Forecast 2020-2030F, USD Million

- Site Identification & Preparation- Market Size & Forecast 2020-2030F, USD Million

- Cash Management- Market Size & Forecast 2020-2030F, USD Million

- Reconciliation- Market Size & Forecast 2020-2030F, USD Million

- Cash Optimization- Market Size & Forecast 2020-2030F, USD Million

By End-User

- Banks

- Independent ATM Deployers

By Country

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Bahrain

- Oman

For more detailed insights and analyses, you can click on any of the available market reports below. If you’re looking for information tailored to your specific needs, we also offer customized reports designed to meet your requirements.

Frequently Asked Questions (FAQs)

- What is the projected growth rate of the GCC Cash Management Services Market from 2025 to 2030?

- Which region is expected to dominate the GCC Cash Management Services Market?

- What are the primary factors driving the growth of the GCC Cash Management Services Market?

- Who are the leading players in the GCC Cash Management Services Market?

- What challenges may impact the growth of the GCC Cash Management Services Market?

Scope of the Report

- Comprehensive market analysis and insights for the GCC Cash Management Services.

- Key trends affecting market growth and dynamics.

- Assessment of competitive landscape and major players.

- Identification of growth opportunities and challenges.

- Detailed segmentation analysis by service type and region.

Browse More Related Report:

- Global Cryptocurrency Market Size and Outlook (2025-2030)

- Global Pasta Market Size and Outlook (2025-2030)

- Global Cheese Market Size and Outlook (2025-2030)

- Global Beer Market Size and Outlook (2025-2030)

About US:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

Contact Us:

MarkNtel Advisors LLP

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India

For Sales Enquiries: sales@marknteladvisors.com